Assume Case B brings after-tax income of 144 per year forever. Expressions for the present value of the tax savings due to the payment of interest or value of tax shields VTS.

Taxable Income Formula Calculator Examples With Excel Template

Wednesday 9 February 2022 For each pound that a contractor earns over 150000 the marginal rate becomes 45 so higher earners pay more tax.

. Assume Case A brings after-tax income of 80 per year forever. The formula for tax shield is very simple and it is calculated by first adding the different tax-deductible expenses and then multiplying the result by the tax rate. In this session we will discuss how companies assess their cost of debt their cost of equity and ultimately their cost of capital.

The Pro-forma feature will carry your W-2s Schedule Cs 1099s and other important documents over from year to year. We therefore assume that the firms WACC is 15 the borrowing rate is given above. Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375.

The value of these shields depends on the effective tax rate for the corporation or individual. Value of firm after-tax income return of capital therefore. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

Sum of Tax Deductible Expenses 10000. Calculating the tax shield can be simplified by using this formula. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate.

The first is the definition of the appropriate rate of tax saving. Indicate the value of the tax shield b y W ACC. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax.

What is the cost of capital. Interest bearing debt x tax rate. Interest Tax Shield Formula.

Larger than the riskless rate we will end up with a. WACC Formula Cost of Equity of Equity Cost of Debt of Debt 1-Tax Rate read more and assume that this proposal is already considered in the calculation of the weighted average cost of capital WACC. The present value of interest tax shields is often written as τ C D as we did in the lecture notes where D is the amount of debt and τ C is the marginal corporate tax rate.

And if the leverage ratio were doubled the debt tax shield could be shown to contribute almost a quarter of the value of the company. The value of a tax shield can be calculated as the total amount of. Depreciation Tax Shield Formula Depreciation expense Tax rate.

Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. One is the impact of personal taxes.

Tax Shield Deduction x Tax Rate To learn more launch our free accounting and finance courses. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Or the concept may be applicable but have less impact if accelerated depreciation is not allowed.

We will also discuss why this last concept is at the heart of many of the most important corporate decisions. Calls to this number are charged at local rates however may vary from other landlines and calls from mobiles may cost considerably more. The effect of a tax shield can be determined using a formula.

Using the information entered Tax Shield intuitively generates a running database to calculate tax liability and determine the necessary forms for your client. The CAPM and the Cost of Capital. This is usually the deduction multiplied by the tax rate.

Tax and accounts software for accountants tax specialists SMEs and business owners. Capital Structure Debt Versus Equity Advantages Of For example lower earners pay no tax then the rate starts at 20 growing to 40 for higher rate taxpayers. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is.

How do you calculate debt tax shield. Under this assumption the value of the tax shield is. Interest Tax Shield Average debt Cost of debt Tax rate.

T ax Shields in an LBO page 8. It to value projects within the firm taking into account the incremental tax shield generated by a particular project. According to the No-costs-of-leverage theory the VTS is the present value of D T Ku not the interest tax shield discounted at the unleveraged.

In addition the effective leverage has declined. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate. However in practice there are several complexities that arise in implementation of the formula.

The Tax Shield Formula Suppose interest payments but not repayment of principal are tax de-ductible. In terms of valuation assume the beneficial tax shield can be assumed by a new buyer. Tax Shield 10000 40 100 Tax Shield 4000.

Approach to valuing the debt tax shield is simply to multiply the amount of debt by the tax rate in which case the debt tax shield would be seen as contributing 12 of total value. Then when you sell the house your equity value is increased by the subsidy on interest payments. 44 0870 609 1918.

Mathematically it is represented as Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate. In this case straight-line depreciation is used to calculate the amount of allowable depreciation. The equity value increases from 40000 to 64000 because of the lower value of debt.

The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below. Two issues arise here. Common expenses that are deductible include depreciation amortization mortgage payments and interest expense.

Tax Shield Formula Uk. Tax Expense is calculated using the formula given below Tax Expense Tax Rate Profit Before Tax Tax Expense 30 80000 Tax Expense 24000 NOPAT is calculated using the formula given below NOPAT Net Income Tax Interest Non-Operating GainsLosses 1 Tax Rate NOPAT 100000 24000 20000 0 1 30. Since the cost of debt in this case is.

Using the above examples.

Effective Tax Rate Formula Calculator Excel Template

Lipsticks Perfect Ones Look By Means Of Moisturising And Longer Lasting Lip Gloss Which Can Give Protection To Hydrate Senegence Lipsense Lipsense Lip Colors

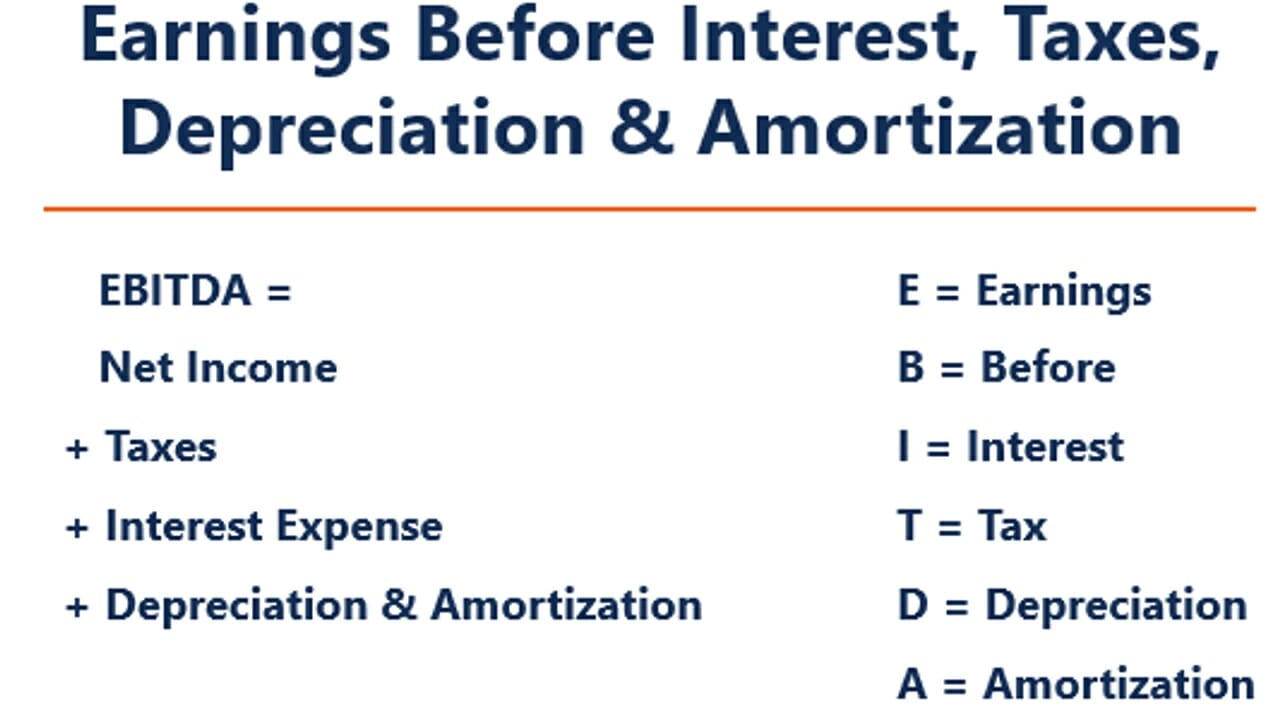

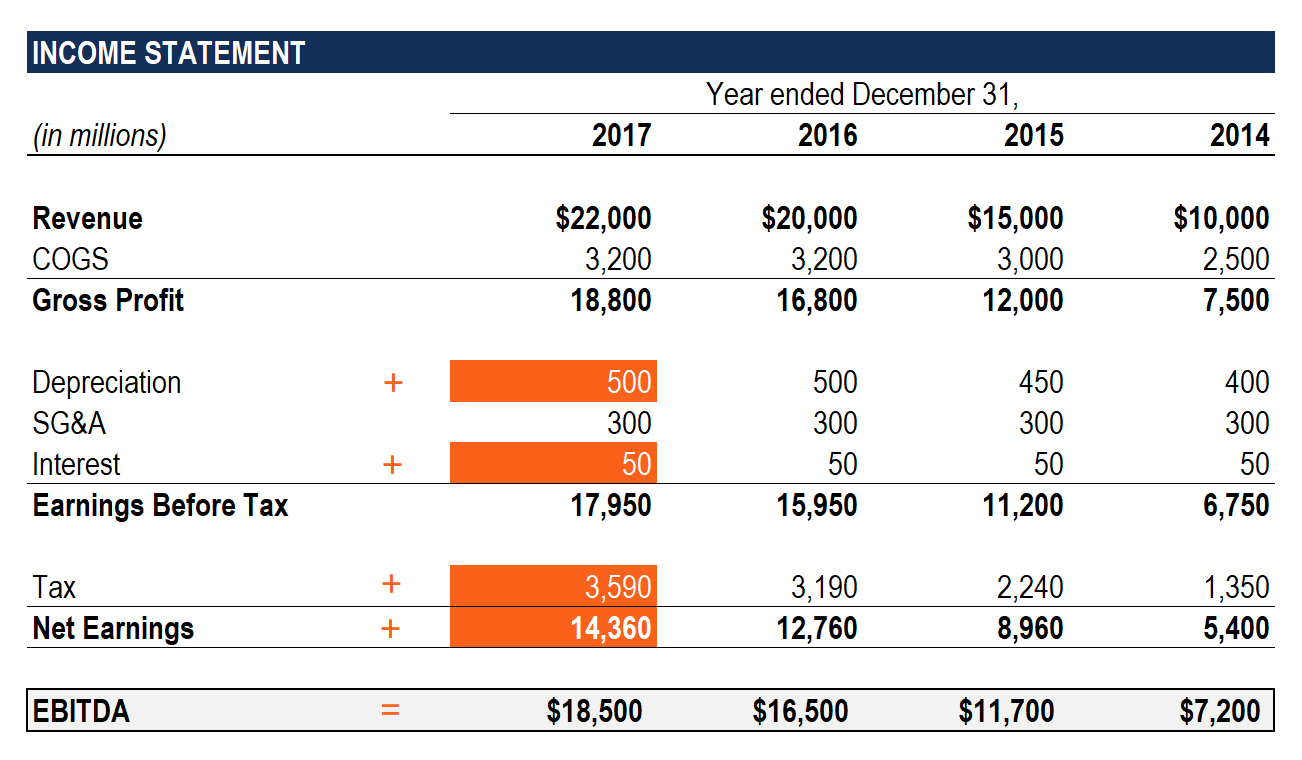

What Is Ebitda Formula Definition And Explanation

Wacc Diagram Explaining What It Is Cost Of Capital Finance Charts And Graphs

Effective Tax Rate Formula Calculator Excel Template

After Tax Salvage Value Formula

After Tax Salvage Value Formula

Any Information About Any Topic Is Available To Solve Your Problems Holiday Shop Book Worth Reading Projects To Try

Effective Tax Rate Formula Calculator Excel Template

Earnings Before Tax Ebt What This Accounting Figure Really Means

Effective Tax Rate Formula Calculator Excel Template

Cash Flow Available For Debt Service Cfads Formula Calculation

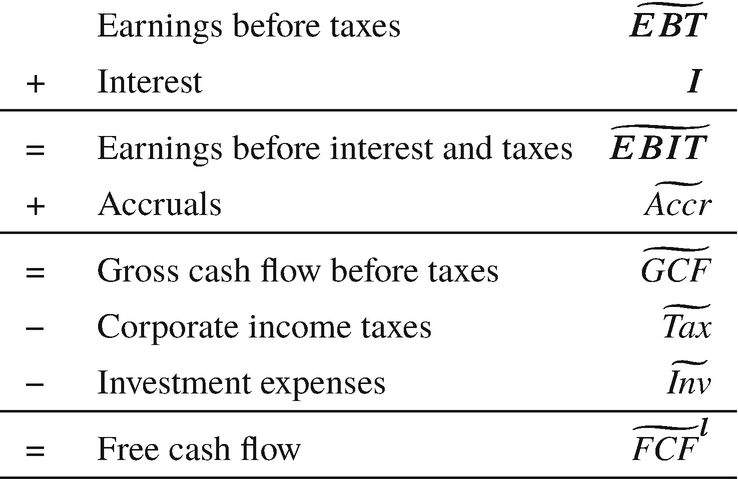

Corporate Income Tax Wacc Fte Tcf Apv Springerlink

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)